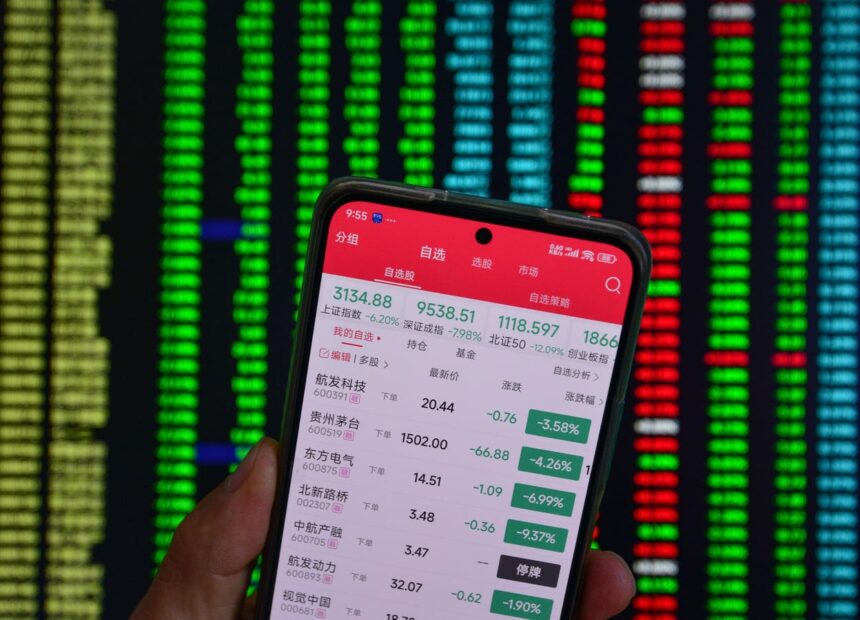

Financiers’ telephone call revealed info on Monday’s A-Shares in Fuyang, Anhai District.

VCG/VCG through Getty Photo

On Monday, Chinese supplies dropped dramatically, a Tit-Tat toll battle with the united state constructed, where the nation’s richest magnate shed thousands of numerous bucks in a day.

After at first showing boosted strength to the Trump management tolls, the nation’s securities market diminished the high cliff as financiers returned from expanded vacation weekend breaks. On Monday early morning, the CSI 300 index noted in Shanghai and Shenzhen tracked shares dropped as long as 7.5%, while Hong Kong’s Hang Seng Index dropped as long as 10.5%.

The marketplace turmoil follows China struck back on Friday, enforcing a matching 34% task on all united state imports beginning April 10. Beijing’s countermeasures additionally consist of limiting the export of particular uncommon planet steels. Revenge happened throughout public vacations, according to the April 5 Nomura research record, with the April 5 Nomura research record claiming the action to Trump’s previous tolls was postponed.

Wechat stated equally as the globe’s 2 biggest economic climates have little passion in discussing in the future, financiers selected to market.

According to Forbes’ real-time billionaire checklist, this caused a leading supply consisting of Hong Kong-listed Tencent, which created almost 10% of package workplace since 11:30 a.m. on Monday, reducing $4.5 billion from the riches of various chairman Ma Huateng, that stays the third-richest male in China with a total assets of $48 billion. Various other significant riches losses consist of a $4.2 billion decrease from Xiaomi owner Bouquet Jun’s total assets, and a $2.5 billion decrease from the riches of Biard founder Wang Chuanfu.

Previously Monday, Chinese magnates represented 4 of the 5 largest losers on the real-time billionaire lineup. In addition, Japan’s Masayoshi boy’s total assets dropped by $2.1 billion to $23.6 billion as a result of the decrease in Japanese stock exchange, as SoftBank noted shares dropped 10%.

When the Indian market later on opened up, Mukesh Ambani, chairman of Dependence Industries, had his riches went down to $5.4 billion to $85.9 billion, and Gautam Adani, chairman of Adani Team, saw his riches of $4.1 billion to $56.2 billion. They are the wealthiest and 2nd wealthiest billionaires in India.

The Chinese authorities pledge to sustain the residential economic climate. Chanson & Carbon monoxide’s Shen stated market blood might finish in a couple of days as plan steps are revealed.

In a content released later on Sunday, an unrevealed analyst in the Federal government Operating Individuals’s Daily composed that China has space to increase its financial deficiency and reduced rates of interest and financial institutions’ book demands. The short article additionally stated that China will certainly take “phenomenal” steps to advertise residential usage and quicken the application of the revealed plans, although it does not offer thorough summaries.

Xin-yao Ng, financial investment supervisor of Singapore-based Oriental supplies, stated through e-mail that China might be “among the most effective ready individuals” as it has actually been with the USA for several years. Some supplies connected to residential usage might have been oversold, he stated, as huge neighborhood markets and future stimulation might imply even more space for development.

Nonetheless, the profession battle might not finish unless Trump resorts. Yet regardless of boosted resistance from both celebrations, his management promised to go on Sunday. He stated countermeasures from China and those that the EU might intend might be the best action.

” For me, diversity far from the USA is the only means onward for any type of nation,” Ng stated. “Inform the USA that it is undesirable and after that collaborate with the remainder of the globe to produce even more bargains, e.g.