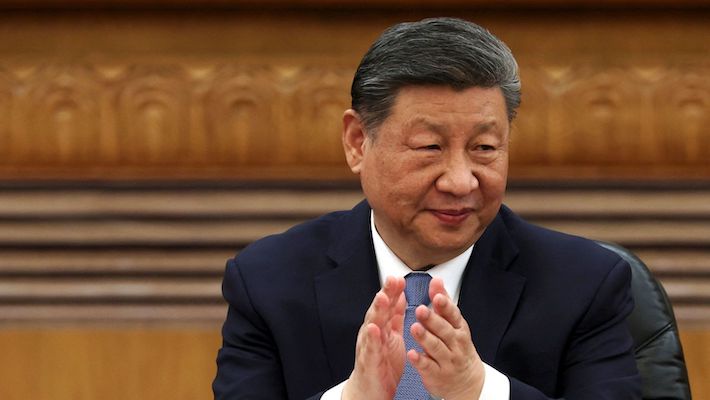

Secure worldwide sectors and supply chains. That’s the message from Chinese Head of state Xi Jinping, that talked to an event of international Chief executive officers on Friday.

Xi Jinping is really disliked concerning chaos, which is thought to be deeply worried concerning the effect of united state tolls on China’s economic climate, which has actually been experiencing a serious stagnation given that the lockdown of the Covid-19-19-19-9 pandemic, offered the injury he and his family members experienced throughout the Cultural Change.

China’s leaders are functioning to remove worries that prevalent tolls enforced by united state Head of state Donald Trump will certainly stimulate a brand-new profession battle.

See likewise: After Trump reveals 25% auto tolls

Yet the nation’s economic climate has actually experienced an excruciating strike by Beijing’s very own plans – China’s anxiety for a very long time Tighten up guidelines, Unexpected Reduce international firms A stagnant affordable atmosphere preferring state-owned Chinese firms has actually likewise deteriorated organization belief.

” Aids keep security”

” We require to collaborate to keep the security of worldwide sectors and supply chains, which is an essential assurance for the healthy and balanced growth of the globe economic climate,” XI informed magnate, consisting of Astras Seneca, FedEx, Saudi Arabia, Saudi Arabia, Saudi Aramco’s employers, Charter and Toyota.

” I really hope every person can take a wide sight and not be stunned by the sector’s quick diversions, instead of thoughtlessly adhering to activities that threaten the protection and security of worldwide sectors and supply chains.”

Concerning 40 execs went to the conference, the majority of whom stood for the pharmaceutical division. A resource that understood straight concerning its strategies claimed the conference lasted for greater than 90 mins and welcomed 7 firms to talk.

” This conference is a broad view of organization diplomacy. Currently, not just discussion has actually happened in between the body, the WTO entity and the nation, however diplomacy is led by firms that stand for not just their very own firms, however likewise their divisions.

Execs beinged in a horseshoe-shaped scenario, with Mercedes-Benz Chief Executive Officer Ola Kallenius and Fedex’s Raj Subramaniam resting contrary Xi Jinping.

HSBC Chief Executive Officer Georges Elhedery, SK Hynix manager Kwak Noh-Jung, Saudi Arabia Head Of State and Chief Executive Officer Amin Nasser and chairman of Hitachi Toshiaki Higashihara, likewise beinged in the initial row.

International financial investment drops

” International business add one-third of China’s imports and exports, one-quarter of the added worth of sector and one-seventh of tax obligation earnings, developing greater than 30 million tasks,” XI claimed.

” Over the last few years, international financial investment in China has actually likewise been stepped in by geopolitical elements … I typically state that burning out other individuals’s lights does not make you brighter.”

Xi Jinping consulted with united state magnate after the China Growth Discussion forum in 2015, questioning concerning whether participants of the leading Chinese leaders’ conference came to be yearly set days after the yearly organization discussion forum. China’s second-place head of state has actually consulted with them off the CDF’s area in the past.

Xi Jinping informed this year’s conference: “The nature of China-U.S. financial and profession connections is equally helpful and win-win.”

Trump reveals a wave of quality Mutual tolls“ To work on April 2, profession obstacles versus united state items target nations, which might consist of China.

He enforced a 20% toll on Chinese exports this month, motivating China Revenge for added tolls on American farming items

Over the previous month, the regularity of conferences in between international execs and elderly Chinese authorities has actually revealed that FDI has actually decreased year by year in 2024 in the neighborhood money term.

This notes the greatest decrease in FDI given that the 2008 worldwide monetary situation.

” From the outdoors, you’re pleased that this discussion resembles a set of documents, however I think that if habits and procedures are adhered to, just after that will certainly we see an adjustment in the FDI fad,” Bernese claimed.

- Reuters with input (top), modified by Jim Pollard