Beijing has actually postponed strategies to introduce brand-new stimulation regardless of pledging Friday to sustain firms and employees under triple-digit tolls on Chinese products.

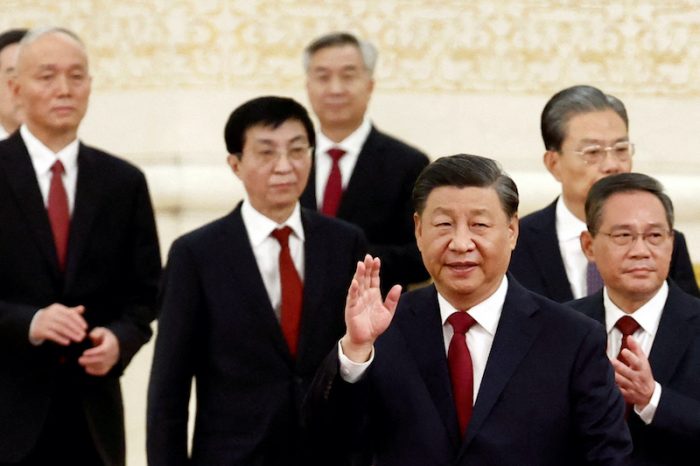

The Politburo, the leading decision-making body of the Communist Celebration, picked to carry out plans much faster than take on brand-new budget deficit procedures, however instead stay tranquil.

The action appears to be the very first wager that Washington has actually blinked in the lengthy profession battle, however intends to preserve versatility in a quickly altering exterior atmosphere.

See additionally: Trump Claims “XI” Called him “He, Stands for Trading in the coming weeks

The choice to keep even more stimulation dissatisfied capitalists, and Chinese realty supplies dropped 3% on Monday regardless of main initiatives to reduce markets’ immediate development.

Experts and plan advisors claim Beijing is currently in a high stimulation equipment and it can be preserved over the following couple of months to relieve the discomfort of the loss, at the very least briefly, its biggest customer.

The absence of brand-new stimulation does not show its high development aspirations this year (matched in 2015’s development) of concerning 5%, however an approach to preserve versatility in the toll battle with Head of state Donald Trump’s management.

” It’s prematurely for Beijing to place it right into method,” claimed Larry Hu, primary Chinese financial expert at Macquarie.

” For Trump, it’s much easier for him to return to the toll hazard than Beijing mosts likely to stimulation news. Furthermore, plan manufacturers can reveal brand-new stimulation any time.”

Newbie, China has actually recommended the execution of its 2025 stimulation strategy.

Federal government investing increased 4.2% from the exact same duration in 2015, while income dropped 1.1%, causing a financial deficiency of RMB 12.6 trillion ($ 173 billion), the greatest very first quarter analysis on document.

Furthermore, city governments released almost 10,000 yuan on brand-new unique bonds throughout this duration, a rise of almost 60% over the exact same duration in 2015. Individuals’s Financial institution of China has actually additionally updated finances to state-backed capitalists to sustain the stock exchange.

Social funding came to a head in March

China’s overall social funding development, a wide action of credit score and liquidity, revealed a 10-month high of 8.4% in March, according to the reserve bank.

Brand-new finances to non-bank establishments held RMB 284.4 billion in February, the 2nd greatest analysis considering that its optimal of RMB 886 billion in July 2015, and it was China’s last significant stock exchange situation. Non-bank finances dropped in March, however experts anticipate April to be solid.

The plan advisor claimed there might be extra to do if required.

” We have actually currently established plan gets – and have numerous backup strategies all set,” claimed a plan advisor.

” The timing of the brand-new plan will certainly depend upon just how much the tolls will certainly impact.”

The 2nd advisor claimed the area for plan easing is still “sufficient”, however included that the brand-new procedures “can not be hurried.”

” We can not shed that versatility,” he claimed. “We still require to assess just how points will certainly go.”

The Politburo declaration additionally noted more decreases in rate of interest decreases and liquidity shots, such as lowering the variety of money financial institutions that have to be held as gets, however resources near the PBOC claimed the reserve bank is not quickly to trim due to the fact that the last effect of the tolls continues to be uncertain.

” The exterior atmosphere has actually transformed so promptly, however included: “If the information begins to wear away in the coming months, the reserve bank will absolutely release a financial stimulation.” “

Development threat

The Trump management advanced a much more reconciliational tone recently. Tariffs are unsustainable And signal to be available to downgrade the profession battle.

Yet Beijing appears to be having a hard time to refute that Trump’s arrangements are underway, and Contact Washington to eliminate tolls

Dan Wang, China supervisor of Eurasia Team, claimed not offering Trump a structure can calm the residential target market, however inside, Chinese authorities “entirely recognize the threats of development.”

She approximates China requires 20,000 yuan in the brand-new stimulation to decrease financial development to listed below 4% this year.

Morgan Stanley experts additionally anticipate brand-new procedures in the 2nd fifty percent of the year to be RMB 1 trillion to RMB 1.5 trillion, “this will certainly not entirely counter the toll shock.”

Nomura principal Chinese financial expert Ting Lu claimed the statement of brand-new stimulation resembles Beijing’s “blinking initially in a poultry video game by revealing stress and turmoil.”

Rather, China wants to “show a tranquility and well-prepared photo” for the profession battle, he claimed.

Nonetheless, this threat is that the threat of expected shock to the economic climate in the future will certainly take longer – and might call for higher plan initiatives to recuperate.

” Their approach is to observe and wait on the united state to break down gradually,” claimed Alicia Garcia-Herrero, primary financial expert at Natixis Asia Pacific, however included: “This approach is really pricey.”

- Jim Pollard’s extra editor Reuters