Samsung is apparently holding off the conclusion of its chip factory constructed in Texas as it battles to locate consumers for innovative semiconductors. This is simply among a collection of difficulties it encounters.

The South Oriental technology titan assured $4.7 billion in gives to the Biden management from the 2nd fifty percent of in 2014, swearing to vouch greater than $37 billion at its Taylor, Texas manufacturing facility, yet resources informed Nikkei Asia The center’s target date has actually gone back to 2026 “since there are no consumers.”

Along with “soft neighborhood need”, a chip supply chain exec was estimated as claiming that the manufacturing procedure Samsung intends to apply at the Taylor plant “is no more conference existing client demands.

See likewise: Exactly how China’s brand-new auto titans complete in the front of the globe

The record claimed building and construction of the plant was finished regarding 92% in March, yet has actually postponed the complicated and pricey installment of brand-new lithography (chip-making) equipments.

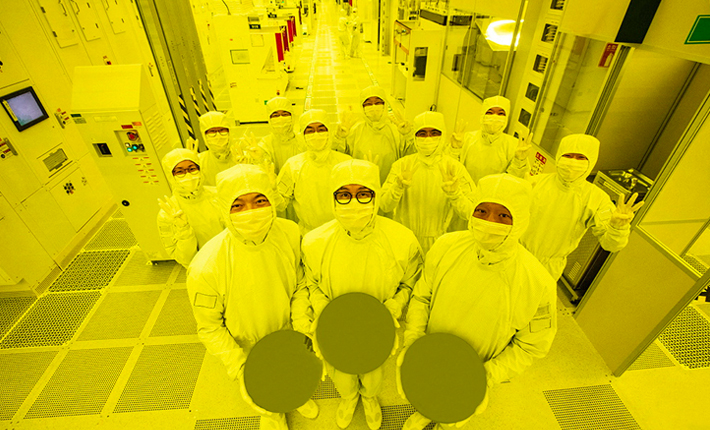

It has actually been reported that fully grown node chips have actually been made in Austin, an additional Texas community for virtually 3 years (because 1996), and Samsung has actually been apparently devoted to enhancing the manufacturing of its 2nm chips and giving even more orders for expert system and various other high-performing computer 2NM and 4NM chips.

Nevertheless, as a result of intense competitors with the USA, South Korean corporations have actually been struck by China’s activities to advertise neighborhood negotiating chip manufacturing. It likewise discovered taking on TSMC, Taiwan’s take advantage of titan and the globe’s leading agreement maker TSMC, which controlled the sector.

At the very same time, adjustments in the united state federal government are an additional significant obstacle.

Much of Samsung’s significant companies– chips, mobile phones and home devices– remain to deal with organization unpredictability over numerous united state profession plans, such as Head of state Donald Trump’s proposition to undefined united state smart device tolls and July 9, in addition to the July 9 target date ” Reciprocatory” toll Battle versus lots of trading companions.

this The Trump management is likewise taking into consideration withdrawing honors to international chip manufacturers Samsung, for instance, makes it harder for them to get our modern technology in their manufacturing facilities in China.

The operating revenue seen has actually gone down

Provided the geopolitical, technical and federal government difficulties encountering chip manufacturers, it is not a surprise that Samsung is anticipated to anticipate running revenues will certainly be up to a 39% decrease in the 2nd quarter tomorrow (July 8).

The major factor results from the latency of giving innovative memory chips to AI Chip Leader Nvidia. The globe’s biggest memory chip manufacturer is anticipated to report operating revenue of 6.3 trillion won ($ 4.62 billion) on April 6, its most affordable earnings in the 6th quarter, according to LSEG Smartestimate.

The weak point of expanding its economic efficiency has actually strengthened financiers’ capability to overtake smaller sized rivals of the high-bandwidth memory (HBM) chips made use of in AI information facilities.

Its major rivals SK Hynix and Micron gain from solid need for memory chips required by AI, yet Samsung As sales counting on the Chinese market are limited by the USA, its revenues have actually been given up.

Its initiatives to obtain the current variation of the HBM chip to NVIDIA accredited by NVIDIA are likewise relocating gradually, experts claimed.

” HBM earnings might stay level in the 2nd quarter as sales limitations proceed in China Samsung claimed Ryu Young-Ho, elderly expert at NH Financial investment & Stocks.

He claimed Samsung It is not likely that it will certainly be essential to deliver brand-new chips to NVIDIA this year.

Samsung the March HBM chip might not make significant progression as very early as June, decreased to discuss whether its HBM 3E 12-layer chip passed the NVIDIA credentials procedure.

Nevertheless, the firm has actually started providing chips to United States firm AMD Stated last month

Samsung Experts claim smart device sales might stay steady as a result of assisting our need for prospective tolls on imported mobile phones.

share Samsung This is the most awful carrying out supply amongst significant memory chip manufacturers this year, climbing up around 19% this year, underperforming and benchmark KOSPI is underperforming.

Since Monday 0447 GMT, Samsung Electronic devices supplies traded 1.9% down, while Kospi increased 0.3%.