Many mindful financiers would certainly not believe that having a solitary possession stands for 40% of their profile is sensible, however that’s the sight that the globe reserve banks have gold holdings.

40% of the computations are consisted of in the most recent evaluation of reserve bank books by leading financial investment financial institution Citi.

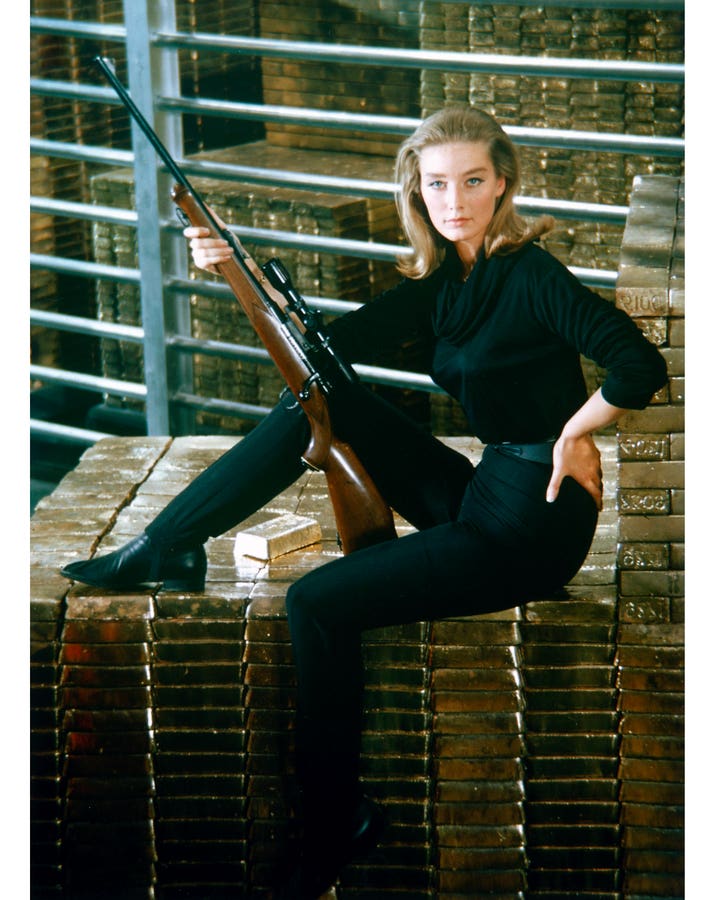

British starlet Tanya Mausoleum rests on a heap of gold bars in Ft Knox as she plays Tilly Masterson in the 1964 movie Goldfinger, 1964. Images of “Display Collection”/” Hulton Archive/Getty Images”)

Getty Photos

Simply 3 years back, reserve banks held 20% of their books.

The fast increase in gold rates to its newest $3,685, combined with the document gold acquisition speed up bought by arising market reserve banks is the gold share that it reaches its highest possible share in three decades.

Citi doubts concerning the gold thrill that can remain to decrease to the anticipated $3,000/ ounce over the following 6 to twelve month, and after that go down to $2,700/ ounce this time around following year.

These future rate pointers will certainly be examined later on today, when the united state reserve bank (the Federal Book) thinks about whether to reduced main rate of interest.

Reduced rate of interest have a tendency to have a tendency to be revealed to gold like financial and political unpredictability, 2 variables that might bewilder Citi’s care.

It is likewise based upon the sight that gold rates might maintain increasing and even more increase, which is the growth of brand-new means to purchase gold, a fairly limited product.

Digital Gold

Digital gold is a principle allowed by the Globe Gold Council, a market hall team, that can raise the gold market as a market for financial investment, while cryptocurrency facilitators are thinking about increasing the duty of gold as a fundamental secure possession.

In both instances, gold needs to be bought and kept initially to allow it to be supplied (and traded) as an electronic item, therefore successfully developing a brand-new type of need.

Citi claimed in its newest version of product market overview that gold financial investment need this year coincides as the weak buck, with significant stimulants more than the anticipated tolls enforced by Head of state Trump and expanding medium-term issues concerning the freedom of the Federal Book.

Surge, however definitely not permanently

Getty

According to Citi’s computations, gold today professions at $4,200 per ounce at 5 previous rates, which has actually made miners of steels a 50-year high earnings, which creates $2,200 per ounce of each of these steels.

High earnings margins motivated keynote audio speakers to anticipate the following stage of the gold thrill will certainly be gold miners’ supplies throughout a mining meeting in Colorado Springs today.

Liechton-based Ronnie Stoferle claimed Gold is running high, however is currently at the beginning of top priority for silver and gold mining business.

Stoferle’s positive outlook is close to the inflection factor with Citi’s sight of gold, which suggests a stable decrease.

Today’s Fed price conference will certainly be a significant examination for gold and its advocates.