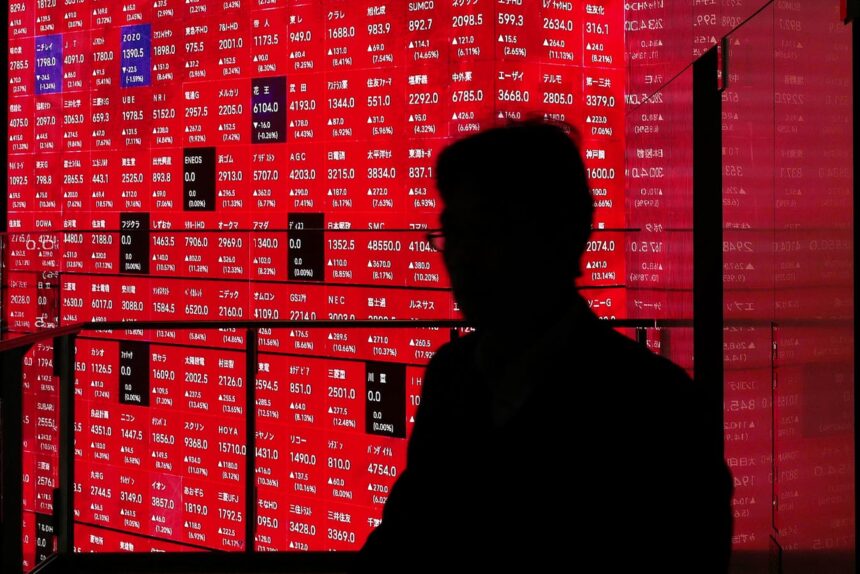

A digital board reveals the Nikkei 225 index on the Tokyo Stock Market in an office complex in Tokyo.

kazuhiro nogi/afp by getty picture

For the previous 2 years, Financial institution of Japan has actually been playing the globe’s most appealing Jenga video game.

Boj Guv Kazuo Ueda has actually taken every action to eliminate a monetary obstacle (e.g., lowering federal government bond holdings), and his group ran the risk of the whole video game to collapse. On Friday, UEDA disclosed strategies to eliminate what might be one of the most harmful challenge: supplies.

Given that 2013, sheds have actually gathered federal government bonds and supplies in extraordinary methods. By 2018, BOJ’s annual report went beyond the dimension of Japan’s $4.2 trillion economic climate, the very first of 7 nations.

That was under the management of Guv Haruhiko Kuroda. In April 2023, UEDA took control of the job of stabilizing rates of interest. By January 2025, UEDA handled to increase rates of interest to 0.5% greater in 2017. And acquisition 400 billion yen (USD 2.7 billion) per quarter.

Worldwide market chaos compelled Boj to reduce that number to 200 billion yen per quarter. Regardless of this, the instructions is still clear. The shed is gradually, however absolutely, the shed is leaving the marketplace.

Currently consists of supplies that are traded via exchanges. Friday was the very first time the footwear lost disclosed it was leaving the supply financial investment video game. By publication worth, Boj’s ETF holdings are roughly 37 trillion yen (USD 25.1 billion). According to market price, the worth of the holding is greater than two times.

Intend to take out the ETF block without the collapse of the whole market. Obviously, this is much easier claimed than done after purchasing the “whale” in the Japanese securities market for several years.

As the experiment advanced, this was really unpredictable. Today, the standard of Nikkei 225 supplies skyrocketed to an all-time high, surpassing 45,000. Since the shed is re-supporting the marketplace, financiers would like to know whether possible financial principles sustain this wealthy supply worth.

Capitalists have great factors to doubt whether the economic climate and emergency of Japanese business can flourish in tolls by united state Head of state Donald Trump. Although Japan ran away with a 15% toll, it was still a financial headwind.

At The Same Time, China is reducing and export rising cost of living, which is the minute when the USA is expanding and linked. As necessary, there is an open concern whether Japan can live a tough setting with mild residential need and simplicity of self-confidence.

Capitalists likewise have legit factors to question why small houses must be certain in the financial expectation when they appear to do not have financial potential customers. The Ueda group will certainly have the ability to obtain increasingly more dream as they go weekly.

Besides the dramatization, it is absolutely unclear that will certainly change Head of state Shigeru Ishiba that surrendered previously this month.

” The expectation for the Japanese economic climate appears intimidating. Exports and commercial manufacturing are dropping due to the fact that the united state tolls are attacking suppliers. And, as rising cost of living is still in advance of timetable, the federal government places its foot on big financial investment things, which is family need, and family need will not conserve a day.”

Angrick included that political unpredictability has actually enhanced. “As a whole, our company believe it is prematurely for his follower to anticipate a significant plan change,” he claimed. The helmsman will certainly require to be irritated with citizens in reaction to the expense of living and the increase of conservative populism. Also prospects that drive monetary development demand to be compared to the Japanese economic climate.

Nonetheless, this unpredictability is the dimming of worldwide expectation in financial and geopolitical terms. On top of that, the primary financial investment in supply video games is the reality that whales are falling back from the marketplace.

Any person presumed everything. Yet at the very least one point is clear: The shed will certainly be really cautious not to weaken the economic system, as it gets rid of one of the most unpredictable Jenga functions to day.